Table of Content

- Price-per-square foot appreciation accelerates for homes selling above $1 million

- Typical home price in Maryland: $415,797 (97% of typical U.S. price)

- Typical home price in the United States: $354,649

- Typical home price in New Jersey: $480,275 (105% of typical U.S. price)

- Wow, home prices are high! (or) Wow, home prices are low!

The average cost per square foot for a multi-sectioned manufactured house is significantly smaller than the average cost per square foot for a single-family site-built house. It is $63,9against $155including installation costs for a manufactured home. Manufactured homes provide the highest quality at significantly lower prices than site-built homes.

All-cash purchases accounted for 27.2 percent of all single family home and condo sales in Q2 2018, down from 28.8 percent in the previous quarter and down from 27.6 percent in Q to the lowest level since Q3 2016. The average price of a home is $263,166, and there are plenty of charming towns like Casper and Jackson Hole. However, according to Best Places, Wyoming jobs have decreased by 1.8 percent. However, the cost of living in Wyoming is 1.9 percent lower than the national average.

Price-per-square foot appreciation accelerates for homes selling above $1 million

The typical cost is less than half the typical U.S. price, which makes up for a median income 25% below the norm. That data doesn't give us a full picture of home prices around the United States. There's no state-level data available for it, and it's only sales prices, so it's not the only way to capture home values. That's why we're also including Zillow's information on home prices.

The average purchase price of a home is $183,031—an increase of 9.8 percent compared to last year. Another spot to check out is Branson—it’s a hot spot known for its music scene and over-the-top Christmas celebrations. If you spend more than 30 percent of your income on your monthly housing payment, you are officially “cost burdened,” according to the Department of Housing and Urban Development . In December, that threshold was easily surpassed in most large U.S. cities, according to RealtyHop’s December 2022 Housing Affordability Index.

Typical home price in Maryland: $415,797 (97% of typical U.S. price)

The tech boom in the Pacific Northwest has boosted the average price of a home to $478,015. Big salaries and an increase in demand have pushed up the cost of living. For instance, the average price of a home in Seattle is $816,718, whereas the price of a home in Olympia goes for $417,726.

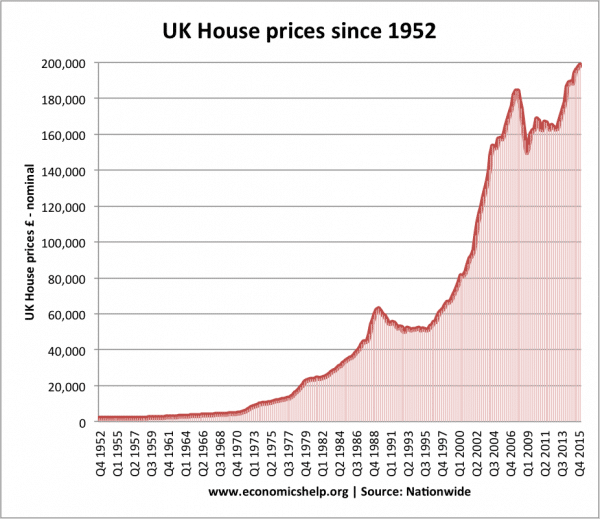

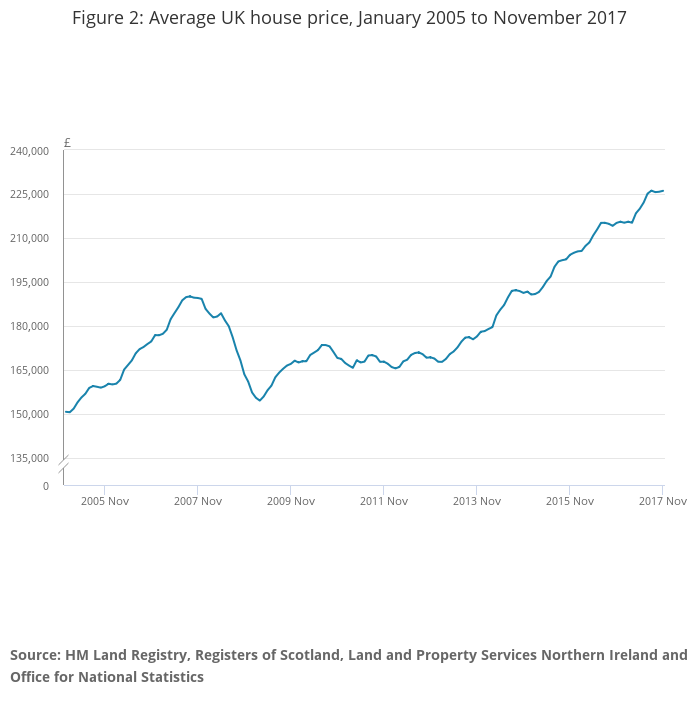

In 1970, the national median home value adjusted for inflation was $107,291; in 2017, it's $217,600 - that's a 103% increase. In fact, more than half of all US States have seen a median home value increase of more than 100%. Note that median means that half of the homes are valued above that number and half below.

Typical home price in the United States: $354,649

Zillow reports that Alaska home values have increase 1.2 percent over the past year. Prospective homebuyers would need to make $100,000 or more to buy a median-priced home in 69 of the 440 counties analyzed in the report , assuming a 3 percent down payment and a maximum front-end debt-to-income ratio of 28 percent . Many are considered to be fixer-uppers, which is understandable, since their prices are on the lower end of the scale. So, when buying a home, it's important to consider repair costs in addition to whether or not you can afford the down payment and the mortgage payments.

The quality of life in places like Providence and Newport is hard to beat. The tiniest state in the nation serves up plenty of big-time rewards, like a beautiful coast, lovely homes, and impressive seafood cuisine. This popular vacation destination has an average home price of $232,164 if you’re thinking about staying.

Typical home price in Hawaii: $1,038,544 (242% of typical U.S. price)

This state's housing prices are less expensive than prices across the country, and the median income is only 6% less than the national median. This resulted in one of the biggest seller's markets in history, although that may be changing as mortgage rates increase and housing supply expands. Now, let's take a deeper dive into what average house prices are like across the country. The Sunshine State has an average home value of $273,094, a 9.3 percent increase from last year. The weather isn’t the only thing that’s hot in Florida—the real estate market is hot due to low mortgage rates, high demand for homes, and a limited supply of houses. Ultimately, 75 of the 100 cities included in the report did not pass muster, requiring more than 30 percent of income to afford a home.

While residents of Alabama own homes with a median value of around $141,000, in the District of Columbia the typical home is worth more than $600,000. Or learn more about how businesses are leveraging ATTOM’s property and real estate data? The $58,000 average home seller price gain in Q represented an average 30.2 percent return on the original purchase price, up from an average 28.9 percent return in the first quarter but down from a recent peak of 30.8 percent in Q4 2017. Median home prices in Q were still below pre-recession peaks in 43 of the 122 metros analyzed for median home prices , led by Atlantic City, New Jersey ; York, Pennsylvania ; Salisbury, Maryland ; Naples, Florida ; and Trenton, New Jersey .

The average house price in Connecticut is $294,046, a 13.1 percent increase over the past year. NBC Connecticut reports that, like many states in America right now, Connecticut is starting to face an inventory shortage. This can make it tough for homebuyers to find the right property at the right price, especially if they don’t act fast. The average home price is $142,225, which has gone up 7.3 percent from last year.

If your mortgage payment is too high, and you can't afford the repairs, you run a greater risk of the home losing value in the market. Your entry-level home also could come through alternative methods, such as ashort sale. This type of home purchase occurs when a seller's mortgage lender agrees to accept a mortgage payoff amount that is lower than the remaining balance on the seller's existing loan.

Incomes aren't enough to balance that out, as they're 10% less than the national median. That doesn't quite pass the 28% rule, which says that your mortgage payment should be no more than 28% of your pre-tax income. The median home price in the U.S. increased by 416% from 1980 to 2020. Mortgage rates fell significantly in 2020, driving up demand as homebuyers looked to take advantage. The pandemic also led to consumers shifting spending to housing and pushed more millennials toward homeownership. However, in vacation destinations, the buying seasons might be reversed, so talk to your real estate agent about the local trends.

The Zillow Home Value Index isn't an average, but it represents the typical home value in a given area. To use individual functions (e.g., mark statistics as favourites, set statistic alerts) please log in with your personal account. Overall, the coronavirus (COVID-19) pandemic has positively influenced the homeownership plans of Americans in 2020.

With an average home price of $195,635, Nebraska is an affordable place to settle down. Housing inventory is pretty tight in Nebraska, though, so expect it to be a seller’s market. The average price for a home in Delaware is $285,750, up 10.3 percent over the past year. Some cities to look into include Claymont, which has an average home value of $244,484, Wyoming, which as an average home price of $202,479, and Ocean View, which has an average home price of $369,740.

No comments:

Post a Comment